Property Tax Is Coming Soon: When Will You Get Your Tax Notice and When Will You Have to Pay It ?

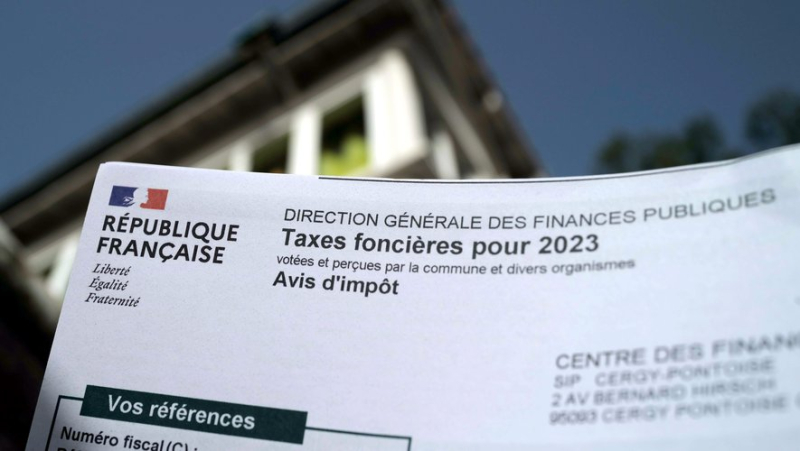

The property tax on built properties is due for the entire year, based on the situation on January 1 of the tax year (illustration). MAXPPP – Bruno Levesque

Property owners are preparing at the end of the summer for a somewhat painful moment of the back-to-school season: the property tax. It's an opportunity to take stock of the deadlines awaiting the taxpayers concerned.

Property owners are preparing at the end of the summer for a somewhat painful moment of the back-to-school season: the property tax. The opportunity to take stock of the deadlines awaiting the taxpayers concerned.

The General Directorate of Public Finances (DGFiP) has informed Capital that notices for taxpayers who do not pay monthly will be available online on the "impots.gouv" platform from August 28 and will arrive in mailboxes no later than September 20. Monthly taxpayers will receive their notice in digital format on September 20 and between September 23 and October 9 in paper format.

The property tax on built properties is due for the entire year, based on the situation on January 1 of the tax year. Therefore, even if you sell your property during the year, you remain liable for the property tax for the entire year.

A two-step calculation

The method for calculating property tax is carried out in two steps. First, the flat-rate revaluation of rental values, indexed to the harmonized consumer price index (HICP), i.e. inflation. In 2023, this revaluation had led to a 7.1% increase in rental values for all taxpayers. Despite a drop in inflation, a new automatic increase of 3.9% in property tax is planned for 2024.

This automatic increase is in addition to the rate increases voted by municipal councils. In Paris, the property tax rate remains at 20.5% in 2024 after a 52% increase the previous year. In Bordeaux, the rate dropped slightly from 48.48% in 2023 to 48.13% this year. In Nice, on the other hand, the city council voted for a 19.2% increase, bringing the rate to more than 35%. In Saint-Étienne, owners will also see a 15% increase, with the rate reaching 48.62%.

In 2023, according to the DGFiP, 33 million owners were liable for the property tax on built properties (TFPB), for a total amount of 50.8 billion euros.