Why property tax soared in 2024 while municipal rates remained stable in the Montpellier metropolitan area ?

Increases have been noted almost everywhere. MAXPPP – THIERRY TONNEAUX

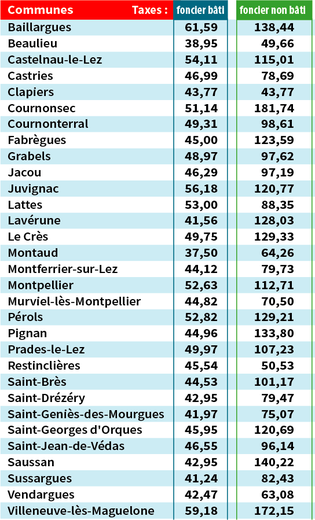

The owners who received their tax notice this year saw their property tax increase in the 31 municipalities by around 7.5% on average. The fault lies in the increase in the bases but also in taxes that are less well known: the TEOM and the Gemapi. Explanations.

This is a paradox. On the one hand, elected officials proudly announce that they have not increased property tax rates and, on the other, taxpayers subject to property tax, who see their property taxes soar.

Two realities that can be explained. For the second consecutive year, after a year of record inflation between 2022 and 2023, property tax in the Montpellier metropolitan area has increased significantly despite unchanged municipal rates. This increase is due to two often overlooked taxes: household waste collection taxes (TEOM) and Gemapi, also known as the flood tax. For 2024, the increase observed is, on average, 7.5%. After a roughly identical increase the previous year. It's starting to get very expensive…

The 3.9% increase in the bases

As we know, the municipalities have not touched their municipal rates and, very often, they have promoted it by assuring that local taxes would not increase. This is false because the primary cause of the increase in property tax is the base. After a historic increase of 7.1% in 2023, it increased this year by 3.9%. It is calculated on the basis of a figure provided by INSEE, which publishes its harmonized consumer price index (HICP) in November of the previous year.

We will also know next month the figure that will serve as a basis for the 2025 property tax, which promises to be lower but still positive. For the past two years, rental values have been rising, reflecting the inflationary crisis of recent months linked in particular to the war in Ukraine.

TEOM and Gemapi

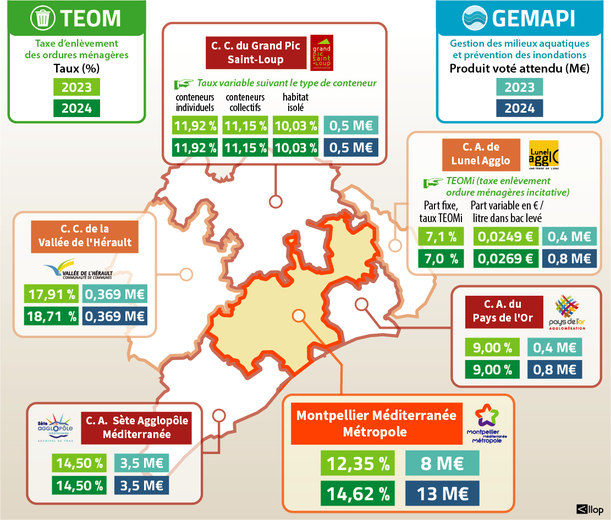

In addition to the increase in the bases, there are two increases in the Montpellier metropolitan area: the household waste collection tax (TEOM) and the Gemapi tax for the management of aquatic environments and flood prevention.

Two taxes that have increased in different proportions. The TEOM has gone from 12.35% to 14.62%. A nice increase that has repercussions on the tax sheet. Just like the amount allocated for the flood tax, which has gone from a desired amount of 8 million euros in 2023 to 13 million euros in 2024. Because this last tax is not a rate but an expected tax revenue, decided in assembly. It is then up to the tax authorities to do the calculations to collect it from taxpayers. In the end, this does not change the fact that it is increasing significantly this year. This is also the case in the neighbouring communities of Pays de l'Or and Lunel.

A political issue

All this has political consequences of course. And these increases have not failed to make the self-declared right-wing candidate for the next municipal elections in Montpellier Isabelle Perrein jump, who sees it as “a hefty bill… The waste of free transport, the millions of euros for useless work… we're going to have to pay", she wrote in a press release.

At the recent Metropolitan Council, Serge Guiseppin, an opposition elected official, recalled that the finances of the local authority were drained. The Montpellier Metropolitan Area has a fairly high level of debt in a community that has “chosen a very proactive investment”, as highlighted by the President of the Metropolitan Area, Michaël Delafosse. Enough to raise fears of an imminent increase in local taxes ?

A new increase in 2025 ?

Nothing is less certain eighteen months before the municipal elections, but the next budget orientation debate promises to be closely watched. Because, as Frédéric Maury of Local Nova points out: “For municipalities, property tax is today the one and only lever to bring in money.”

Furthermore, we will know the increase in the bases for the 2025 property tax next month. After 7.1% and 3.9%, specialists agree that it will be around 1.5%… It's better, but it's still an increase!

I subscribe to read the rest