Property tax level: the region’s municipalities have not really been heavy-handed in 2024

Les communes de la région ont, en général, fait preuve de retenue dans la hausse de la taxe foncière pour 2024. MAXPPP – Bruno Levesque

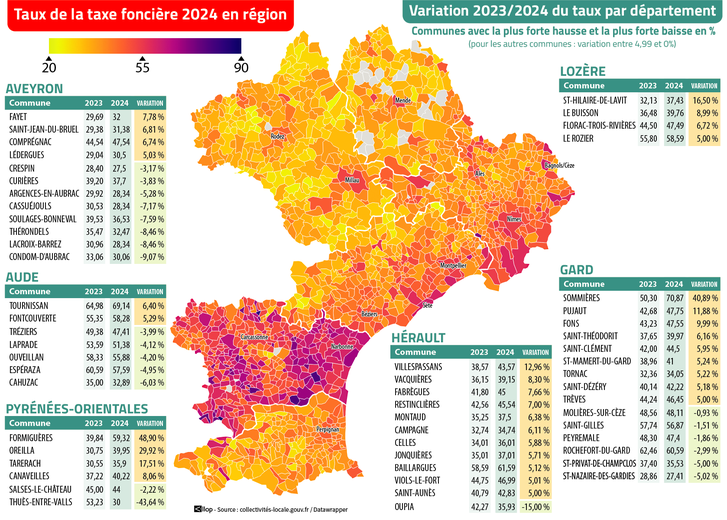

Only a few municipalities, such as Formiguères in the Pyrénées-Orientales or Sommières in the Gard, have voted for significant increases in their rates. Large cities have opted for a stable rate. Explanations.

“For municipalities, it is today the one and only lever to bring in money”. Founder of LocalNova, a Montpellier-based consulting firm specializing in local finances, Frédéric Maury sheds light on the weight taken by property tax in the taxation of local authorities.

“When the State abolished the housing tax as part of the 2020 Finance Act, it transferred the property tax rate, which the Departments had previously received, to the municipalities. This had the effect of seeing the rate of this tax allocated to the municipalities increase considerably. But it was not, at the time, their fault”, he explains.

Property tax notices sent at the end of August

Since then, at the start of each school year, the news of sending, as has been the case since the end of August, the notice of the built property tax, or property tax (TF), to taxable taxpayers is scrutinized with a magnifying glass. Will the municipalities, this year, be heavy-handed on the TF tax rate?? Verdict: in most cases, they have shown moderation.

Thus, in the main large cities of the region, there has been no increase. This is the case for Montpellier, Nîmes, Carcassonne, Castelnaurady, Millau, Rodez and Perpignan. The TF change is 0% for the year 2024. In reality, few municipalities have been forced to vote for a fairly significant increase. Not to say significant.

Formiguères, placed under the supervision of the prefecture

According to calculations made by LocalNova for Midi Libre, the highest regional increase is the work of the commune of Formiguères, in the Pyrénées-Orientales: + 48.90%. It is followed by the Gard commune of Sommières: + 40.89%. Next comes Oreilla, in the Pyrénées-Orientales: +29.92%.

The case of Formiguères is quite special: the municipality was placed under budgetary supervision by the Pyrénées-Orientales prefecture in June 2024. It was unable to vote on a budget within the deadline. And it was the Regional Audit Office that established the budget for the current year. In Sommières, the mayor decided on the increase last February. His municipality was financially “on the verge of breaking point”.

“Local authorities cannot create debt”

But, in an opposite approach, some municipalities have chosen to lower the TF. This is particularly the case of Thuès-entre-Valls, a small village in the Pyrénées-Orientales, which lowered it by … 43.64%. Going from 53.23% to 30%. Or in Oupia, a village in Hérault, where the drop is 15%.

“81% of large cities have maintained their rate”

Local finance consultancy FSL has published a study on the evolution of property tax levels in French cities. Only six of the cities with more than 100,000 inhabitants have chosen to increase their rate. “In a constrained context, large cities and their own tax groups have generally increased their tax rates, although in a moderate manner, explains FSL. On average, the rates of housing tax and property taxes will increase by +1.2% in 2024. Outside Paris, the increase in rates will be at +1.2% in 2024. +1.6%, after +1.7% in 2023. So, “81% of large city territories (34 out of 42) have maintained their rates in 2024. This proportion is up compared to 2023 (76%) and 2022 (69%) but down compared to observations for the 2017-2021 period”. This proportion rises to 84% for municipalities with between 40,000 and 100,000 inhabitants. The increase is 0.6% on average. "This increase is less than in 2023 (+1.3%) and close to the changes recorded in 2022 (+0.9%), 2021 (+0.8%) and 2020 (+0.4%)".

"We observe that the highest rates are often located in the least wealthy municipalities, specifies Frédéric Maury. And today, there is only taxation to allow them to replenish their cash flow". Especially since, as Pascal Gourdel, deputy for finance at the City of Nîmes, reminds us, "unlike the State, local authorities do not have the right to create debt".

I subscribe to read the rest