Real estate credit: borrowing, return of banks, purchasing power… the fall in rates is confirmed in February

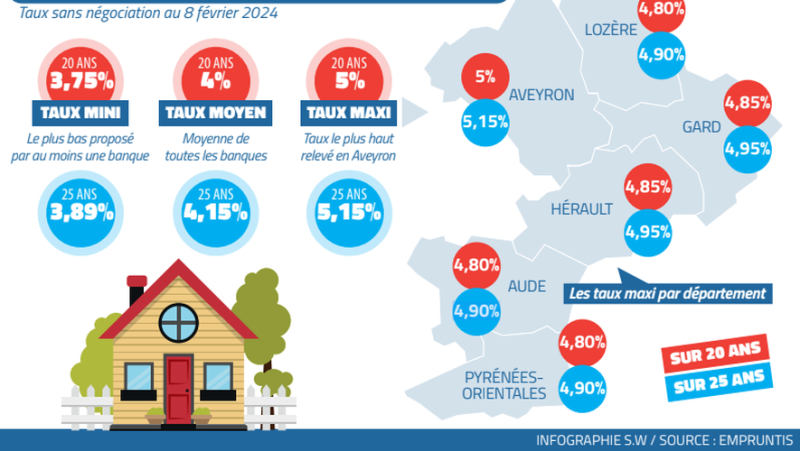

Comparison of real estate rates in the region as of February 8, 2024. Infographic Sophie WAUQUIER

With the return of banks to the home loan market, new opportunities are now available to candidates for home ownership. But we are not yet back to normal.

All real estate credit professionals agree on this: the increase in rates observed since the end of 2022, which has removed a large number of candidates for the acquisition of property from the market ;#39;housing, is now stopped. They even see a decline. Explanations.

Is the rate cut significant ?

If we take the good old formula of "he who does not advance, retreats" and we apply it to the evolution of home loan rates, then yes, we can say that it is significant.< em> "In the former Languedoc Roussillon, we observe rates lower than 4%, offered by certain banks", notes Cécile Roquelaure, director of communications and strategic marketing within the Empruntis group, a network of brokers present throughout France. And if other banks show 5%, the difference is "depending on the banks and profiles".

According to Maël Bernier, spokesperson for Meilleurtaux, another major network of real estate loan brokers, "the drop is definitely there". "But, above all, she adds, we are witnessing a return of banking establishments which no longer lent" ;. It also observes an offer of rates "less than 4% over 20 years". As for Pretto, leader in online brokerage, it notes "a significant drop in real estate loan rates". The drops "recorded reach an average of 0.2%".

Manager of two Empruntis agencies in the Montpellier region, Julie Beaufils perceived, "as early as last December, the beginnings of a drop in rates in the region" ;. This drop is accompanied by another piece of good news: "individuals benefit from more negotiation capacity".

How much can you borrow ?

According to Empruntis, which has several agencies in the Montpellier, Nîmes, Narbonnaise and Perpignan regions, "at least one bank" of the region displays a rate of 3.75%, the lowest rate observed, for a 20-year loan. The highest oscillates between 4.80% (seen in Aude, Lozère and the Pyrénées-Orientales) and 5% (seen in Aveyron). The average being 4%.

"Important national financial institutions mark their return with more attractive rate proposals than in recent months", we specify at Pretto. Depending on income, the rates are more or less attractive. Thus, still according to Pretto, we can, for a period of 15 years, obtain a rate of 3.93% if the annual income is less than 40,000 euros, 3.83% if it is between 40,000 euros and 80,000 euros, and 3.65% if it is greater than 80,000 euros.

Why are the banks back ?

Because "banks are in the process of winning back fairly large numbers of new customers", explains Maël Bernier. So, "we can put them in competition". "Real estate credit is a winning product for banks, it allows them to win over new customers", confirms Cécile Roquelaure.

Real estate purchasing power should remain low

The real estate purchasing power is the number of square meters that one can acquire, depending on the monthly payment that one's ;nbsp;is able to pay and the duration of the loan granted. According to Meilleurs Agents, a specialist in real estate valuation, "despite the drop in prices which has begun, real estate purchasing power should remain very low". Even with a drop in rates, as observed since the start of the year, "they will remain sustainably higher the average levels that the French have experienced in recent years", insists Thomas Lefèbvre, scientific director of Meilleurs Agents. Which "will not be likely to make households resolvable". Especially, he adds, "as prices have not fallen sufficiently in 2023 to compensate for power problems d’ real estate purchase". But this should nevertheless suggest “foreshadow a further drop in prices in 2024, certainly more marked than that observed in 2023". Conclusion: "the degree of improvement in real estate purchasing power will depend on the interaction between price trends and interest rates" ;. Everything is relative, however. "Between January 2023 and February 2023, we have already recovered 3.5% of borrowing capacity", notes Cécile Roquelaure, of Empruntis. But, since January 2022, "we have lost 25% of purchasing power". There is nevertheless hope, with the start of a drop in rates. "For a couple earning 40,000 euros, this reduction allows them to gain between 10,000 euros and 15,000 euros in borrowing capacity", analyzes Maël Bernier de Meilleurtaux.

If banks are now also involved in home loans, it is because money is cheaper. "The cost of refinancing banks began to stabilize last September, then to fall, deciphers the latter. As a result, they can start conquering new customers". Consequence: "in January, we saw one bank in two lower their rates and in February two banks in three".

I subscribe to read more