Very established low-cost companies: “Regional airports which are Ryanair-dependent may be at the mercy of its arbitrage”

Paul Chambaretto, professeur à la Montpellier Business School, spécialiste de l'aérien : “Air France a délaissé les dessertes domestiques, peu rentables”.

Interview with Paul Chiambaretto, professor at Montpellier Business School, director of the Pégase Chair, specialist in air transport. It confirms the ever-increasing weight of low-cost companies in regional airport traffic.

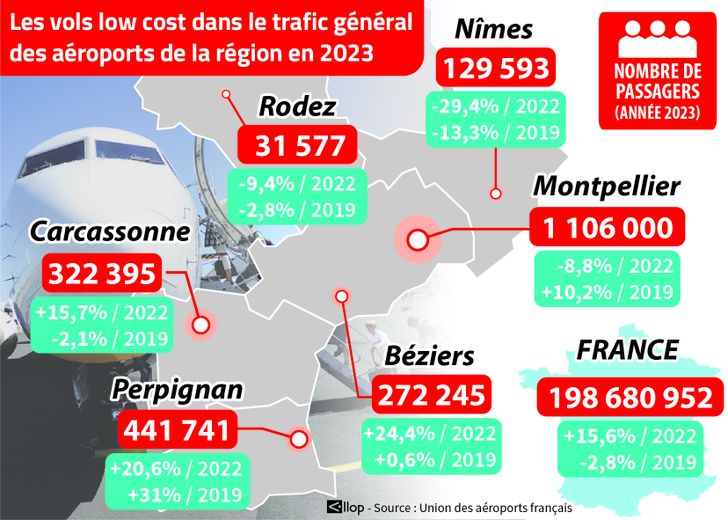

Low-cost companies have once again, in 2023, driven traffic at French airports, and particularly those in our region. Does this mean that they have become essential??

We can indeed observe, overall, that it is the low-cost companies which, today, keep the airports alive in the former Languedoc Roussillon and, beyond, elsewhere. ;Occitanie. Except, however, that of Toulouse, where Air France is the leading airline. What is obvious is that the airline sector has accelerated its development thanks to low-cost airlines.

And Montpellier airport ?

At Montpellier airport, until 2019, it was Air France which dominated traffic. It was the first airline. From 2020, when the French group decided to transfer its service from Paris to Orly to its low-cost subsidiary Transavia, the latter became the leading company in terms of seat supply , with 30% of the overall supply. Afterwards, it is obvious that companies like Volotea, easyJet or even Air Arabia have taken a prominent place.

How to explain this evolution?

Traditional airlines today tend to abandon regional airports. For Air France, the domestic and European markets are two structurally loss-making markets. The national company only keeps the service to Paris-Roissy to supply its Charles-de-Gaulle hub to its international destinations. On domestic flights, Transavia has costs two to three times lower than those of Air France. It's all about competitiveness. For the French group, it is also a way of responding to competition from the TGV on the market between Montpellier and Paris.

What are the factors that make up the business model of an airline ?

What plays the biggest role in an airline's market share is prices, of course, but also frequencies. A company like easyJet is not necessarily, from Montpellier for example, competitive in all destinations. It is especially so in London, to the extent that it is the only one to offer it. In addition, you should know that in France, domestic air traffic faces strong competition from trains on the Paris-Province line. But it is not competitive for a service between two regional cities. This explains the disengagement, in recent years, of Air France, then of Hop! on this type of service.

The weight of low-cost airlines in regional airport traffic is imposing.

This opened the way for companies with a very aggressive strategy, like Volotea, which has a very significant offering on the national market. In 2022, it would serve more routes than Air France. Their approach is very intelligent. They exploit a whole untapped market, that of Province-Province roads, where alternatives are limited. It’s no coincidence that Volotea is one of the fastest growing companies.

What about other airports in the region ?

If we look at the companies which are in Nîmes, Béziers or even Carcassonne, we observe that there is a strong dependence of Occitanie on Ryanair. Some airports work 95%, or sometimes 100%, with the Irish low-cost airline. This puts these airports in a situation of dependence on a single company. Which raises the question of the sustainability or survival of regional airports if, tomorrow, Ryanair were to change strategy.

Why ?

Ryanair only works with one aircraft manufacturer, Boeing. However, the American manufacturer is experiencing major difficulties in supplying Ryanair with aircraft, which continues to grow. And who therefore needs more and more planes. However, if it does not have them, it will have to reorganize its programs and concentrate its planes on the most profitable routes. Will it decide that its lines to the region's airports are no longer so?? Our airports which are Ryanair-dependent may be at the mercy of the arbitrations that the Irish company would make. This is also what is happening in the United States.

However, the presence of low-cost companies in the region is a plus for regional tourism.

It is mainly foreigners who come on vacation to us who use these low-cost lines. In certain destinations, it is also medical tourism. Montpellier and Toulouse have developed a strategy which allows them to have more balanced traffic, with equally significant outgoing flows, thanks in particular to the Portuguese or Moroccan diaspora, who travel on tourist routes for personal reasons.< /p> I subscribe to read more