Budget 2025: 110 billion euros deficit, a debt of more than 3,000 billion euros… the reasons for a deficit that has become uncontrollable

Michel Barnier va devoir batailler pour faire adopter le budget 2025. MAXPPP – JULIEN MATTIA

Avant la présentation en conseil des ministres du projet de loi de finances (PLF), l’économiste Éric Heyer décrypte la situation budgétaire du pays et son déficit qui s’aggrave inexorablement.

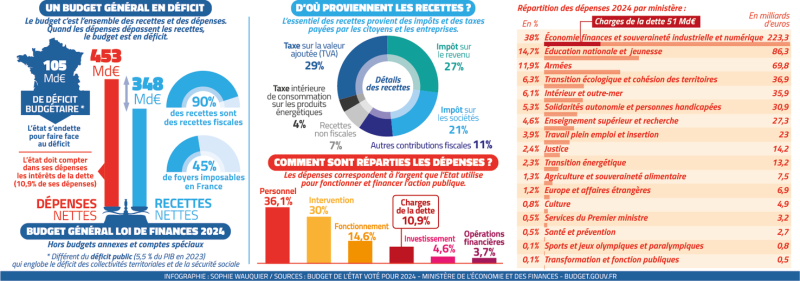

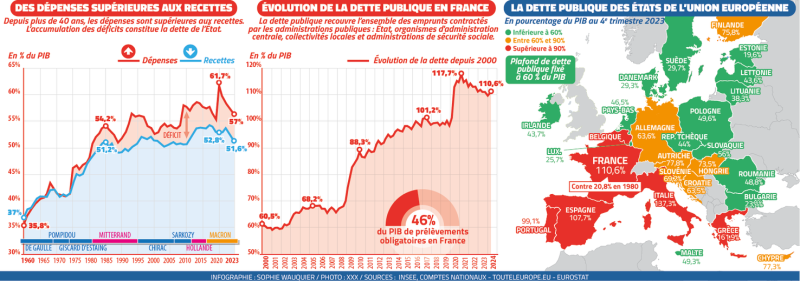

This is the first real challenge for the Barnier government: managing to finalise a budget for 2025. While its examination will begin in a frenzied political context, the latest available figures reveal a more than complex situation. Public debt has exceeded 3 trillion euros, or 112% of GDP, and its deficit, currently at 105 billion euros, could slip to 5.6% of GDP in 2024 and 6.2% in 2025, far from the 3% target set by the European Union. Brussels has also placed France in an excessive deficit procedure with Italy, Poland, Belgium, Hungary, Slovakia and Malta. “The 2025 budget will undoubtedly be the most delicate, or one of the most delicate, of the Fifth Republic”, warned the President of the Court of Auditors, Pierre Moscovici. “The situation is very serious”, Michel Barnier himself admitted. Is it really so "serious" ? Elements of response and analysis with Éric Heyer, the director of the analysis and forecasting department of the French Economic Observatory, on the eve of the presentation of the draft finance law in the Council of Ministers.

For economist Eric Heyer, the problem mainly comes from the fact that the deficit is not going down again. MAXPPP – Vincent Isore

1- Is the situation really that serious ?

"No", reassures Éric Heyer, in any case, if we hear behind this warning from the Prime Minister a risk of bankruptcy and loss of confidence of the financial markets. "This is not the case", he reassures. He nevertheless perceives another form of seriousness. “The problem lies rather in the fact that we do not understand why, in 2024, the deficits continue to remain high when they should be reduced”. The economist deciphers: “Before the crisis, in 2019, France posted a deficit of 2.3% of GDP, in the high average of Europe certainly, but in line. With Covid, we put in place the whatever it costs, the deficit increased, and that was normal. Likewise with the shields installed to absorb the crisis of energy costs linked to the war in Ukraine. But these measures are now over, inflation has stabilized, so the deficit should start to fall again. But this is not the case and that is what is annoying”. Above all, fears Éric Heyer, “in this uncertain political context that could prevent the necessary measures from being voted on“.

2- How did we get here ?

According to Éric Heyer, it is not the two successive crises, that of Covid and then of energy price inflation, which are at the origin of this budgetary situation. “The other European countries have also suffered the double crisis, they have put in more or less the same public aid, but do not show, today, the same deficit”. We must therefore look for the key elsewhere and according to the economist, this would be the consequence of the failure of President Macron's trickle-down policy.“Since 2017, we have reduced the tax burden considerably, by 63 billion euros, or 2 points of GDP, but without financing it by reducing public spending. The bet, with this gigantic supply shock, was to gain competitiveness, therefore growth, and thus obtain more revenue to self-finance this tax reduction. Lost bet. We're paying the bill for unfunded tax cuts”.

3- Is this the most serious crisis in the story?

There are two ways, according to Eric Heyer, to measure a financial crisis. The first is by observing interest rates on public debt. “We are currently at 2.9% at 10 years. That is to say, lower rates than during the financial crisis (of 2008, Editor's note) when they reached 4.5%”, he observes. Another indicator is the OAT-Bund “spread”, which indicates the rate gap between France and Germany. “It was on average, in 2012, at 1.5 points compared to 0.8 today”. Not huge, especially since at the time “we didn't talk about bankruptcy any more”. Except that, the economist qualifies,“it has been multiplied by a little more than two since the Covid crisis, when it stood at 0.35 points“. Eric Heyer therefore speaks of a moment of “strong tension”.

4- Local authorities guilty?

The controversy fueled the summer news. Bercy, through the voice of the then ministers Le Maire and Cazenave, accused local authorities of fueling France's deficit. The Court of Auditors, in the process, revealed that while the financial situation of municipalities and inter-municipalities continued to improve (+1.2 billion euros in gross savings), that of the regions is in decline (-0.4 billion euros) while that of the departments has deteriorated (-4.7 billion euros). What does Eric Heyer think about it? ? “They do indeed have a share of responsibility”, he replies, explaining: “We build a budget on a growth scenario. Based on the principle that 1% growth produces 1% revenue according to the principle of elasticity of tax revenues to the economic cycle, the State assigned a level of expenditure to local authorities last year. Except that if we did indeed achieve 1% growth, this was driven by exports and not consumption as expected. During the year, the State therefore asked them to reduce their expenditure. But since they had already started their programs in the first half of the year, they were unable to rectify the situation", summarizes the economist.

This reflects a problem: local authorities no longer have real tax levers, the majority of their revenue depends on State grants. “This has removed the direct link with the taxpayer”, thus a form of responsibility. “It is easier to be a stowaway. To spend a lot and then say that the State does not give enough“. Eric Heyer also points out “a small drift in employment” not correlated with population increase.

5- Is France at risk of a "shutdown" ?

The threat often hangs over the United States, but never in France: could the country's budgetary situation lead to a “shutdown”, that is, a shutdown of the State and public services, including the non-payment of civil servants' salaries. “This is not a budgetary hypothesis but a political one”, recalls Éric Heyer. He explains: “A shutdown only occurs if Parliament does not vote on the budget before December 31, due to a lack of political majority”. However, in this case, the executive branch retains the possibility of renewing the budget “by decree”. It is therefore useless, “to play at being scared”. However, adds the economist, we would end up with “a very politically restricted budget” at a time when the situation calls for strong decisions.

6- Can we achieve the “3%” target ?

This is the constraint imposed by the European Union: France, like all Member States, must bring its deficit below 3% of GDP, the threshold set by the Stability Pact voted in 1997. Is this possible, given that we are going to exceed 6% at the end of the year ? “We must “hope”, responds Eric Heyer, who warns “but it is no longer reasonable to think of achieving it by the end of Emmanuel Macron's five-year term, in 2027”. Explanations: “To do this, the deficit would have to be reduced by one point per year. This is possible with 3% growth, but we know that we are far from that. The other hypothesis would then be to ask citizens to make an effort of 30 billion euros per year, but without this reducing the purchasing power of households and the financial situation of companies. However, it has been established that 1 euro of austerity generally reduces activity by 1 euro, or 50 cents less in revenue. This would mean that to return to 3% by 2027 without impacting revenue, it would be necessary to double the effort to 2 points per year, or 60 billion euros of savings. Forget it, it's impossible, ““, the economist snaps. According to him, the “reasonable” objective would therefore be to smooth out this reduction in the deficit”rather over 5 to 6 years”. “By reducing it by 0.5 to 0.7% of GDP per year, we set a trajectory and regain the confidence of our partners. This still represents an effort of 20 to 30 billion euros per year, which is already complex to achieve".

7- But is it really necessary to reduce this deficit ?

The question may nevertheless arise: is it mandatory to respond to the injunction from Brussels and reduce the deficit to 3% of GDP. "Yes, it is obviously important",Eric Heyer responds immediately, recalling that in the event of non-compliance with the rules, Brussels can impose financial sanctions against a Member State of up to 0.1% of GDP, which would represent nearly 2.5 billion euros for France.

However, the economist specifies, it would be possible to ask Brussels to stay with a 6% deficit, “provided that this choice is justified, for example by a major investment plan in the ecological transition”, he illustrates. He adds: “contrary to popular belief, the European Commission is very flexible and allows room for maneuver”. And Eric Heyer mentions the case of Italy, whose deficit is now 7.2% of GDP, “but which has put 100 billion euros on the table to revive the construction and housing market”, to restore growth. However, this is not the path that France seems to be taking.

8- A problem that is mainly political ?

According to Éric Heyer, the problem facing France is ultimately more political than budgetary. While the situation requires strong measures, "the instability in the National Assembly is pushing each group to set red lines. There are those who do not want to touch businesses, others the inactive, still others the public services… The red lines of the New Popular Front are not those of Macronie, which are still different from those of the National Rally. The risk, to avoid a motion of censure in this hemicycle without a majority, would therefore be to avoid strong acts”, fears the economist.

Another obstacle, points out Eric Heyer, is the legacy of the aid granted to overcome the energy crisis. “Most European countries, considering that it was an external shock, decided to let inflation run its course and to compensate households and businesses that needed it with subsidies in the form of energy checks. The French method, to counter inflation, was to put shields on prices, ultimately helping everyone at the same level. This was effective, certainly, but it cost more and, above all, individuals and businesses were not aware of the level of aid they received from the State. Asking them today to make an effort in return through a tax increase will perhaps be more complicated“. A double political pitfall which, he says, makes the situation worrying when it comes time to vote on the 2025 budget.

I subscribe to read the rest