Property tax: in which large cities will it increase the most in 2024 ?

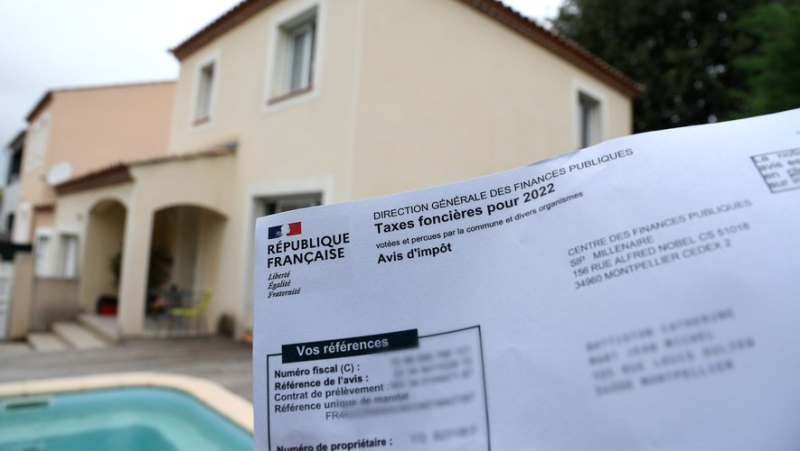

La taxe foncière suit aussi l’inflation. Archive Midi Libre – JEAN-MICHEL MART

La plupart des grandes villes ont fait le choix de maintenir leur taux inchangé. Mais l’inflation relévera tout de même le montant pour les contribuables.

Big cities – more than 100,000 inhabitants – and their groups have decided to increase their property tax by 1.2% on average this year, and more of them than in 2023 are keeping their rate unchanged, according to the annual survey from the FSL firm. Cities of 40,000 to 100,000 inhabitants are even more reasonable this year, according to the study published this week, which compiles the decisions of communities every spring.

It is therefore overall a slight relief to come compared to increases felt to be strong in 2023, particularly in Paris where the rate had suddenly increased from 13.5% to 20.5%. ;%, an increase of 52%. Despite this massive increase, Paris still has the second lowest rate among large cities, after Boulogne-Billancourt (15.09%).

34 large cities out of 42 maintain their rates

For their part, Angers, Caen, Dijon, Le Havre, Montpellier and Nîmes have rates above 50%, with a record of 65.79% for Grenoble . None of these cities increased their rates this year.

In total, 34 large cities out of 42 (81%) maintained their rates in 2024, notes FSL, after 76% in 2023 and 69% in 2022.

Outside Paris, the average increase is 1.6% after 1.7% last year. Including Paris, the increase reached a record 10.9% last year. This year, the most gourmet cities are Nice (+19.2%), Saint-Étienne (+15%), Nancy (+14.5%), Annecy (+14. 1%) and Villeurbanne (+10%).

In the 154 towns of 40 000 to 100 000 inhabitants, the property tax rate "changes very moderately" , FSL rating, +0.6 % on average, after +1.3 % in 2023, +0.9 % 2022, +0.8 nbsp;% in 2021 and +0.4% in 2020. 131 of these cities, or 85%, maintained their rate in 2024, 18 increased it (12%) and 5 decreased it.

L’consumer price index

Taxpayers required to pay property tax will, however, all experience an increase of 3.9% this year, even in municipalities which have not increased their rate. Regardless of local decisions, the tax is in fact increased each year by the annual amount of inflation. The calculation is carried out in the month of November preceding the tax year, taking into account the European harmonized consumer price index (HICP), generally close to the national index.

With the decline in inflation, this year's 3.9% is however far from the 7.1% increase in 2023, and the increase is expected to continue. reduce in 2025.